Did you know that a whopping 80% of consumers prefer using cards over cash for their purchases? As a savvy WordPress site owner, it’s time to embrace this trend and make it incredibly easy for your customers to pay with credit cards.

Businesses that don’t provide smooth and secure checkout processes risk being perceived as outdated or unreliable. By leveraging the right plugins and payment gateways, you’ll not only offer the convenience of credit card payments but also boost your credibility in the eyes of customers who expect secure and efficient online transactions.

In this article, we’ll explore various ways to accept payments on WordPress site, focusing on the most popular payment gateways and plugins.

Why Accepting Credit Card Payments is Important on WordPress?

Accepting credit card payments on your WordPress site can provide an enhanced customer experience, increased sales and revenue, and improved security.

Increased sales and customer satisfaction

Credit card payments are typically processed faster than other methods like bank transfers, ensuring a smooth shopping experience for your customers. By offering credit card payments, you make it easy for customers to complete transactions without hassle. This convenience leads to increased sales and happier customers.

Faster payment processing

Credit card payments are authorized instantly, allowing you to receive funds quickly and manage your cash flow more effectively. With faster payment processing, your business can access funds sooner and reinvest in growth or cover operational expenses.

Expanding your customer base

Many payment gateways support multiple currencies, allowing customers to pay in their local currency, which can lead to higher conversion rates. Credit card payments enable you to reach customers worldwide, expanding your customer base and increasing potential revenue.

Supporting recurring payments and subscriptions

Recurring payments and subscriptions can provide a predictable and steady revenue stream for your business. Accepting credit card payments allows you to offer flexible payment options such as recurring payments and subscriptions, giving customers more control over their spending.

What Are The Key Factors To Consider To Accept Credit Card Payments On WordPress?

Before you start accepting credit card payments on your WordPress site, there are a few key factors to consider. By addressing these points, you’ll ensure a smooth, secure, and efficient payment process for your customers.

Security and Privacy Concerns

Protecting Customer Data

- SSL Certificates: Implementing SSL certificates on your website helps encrypt and safeguard sensitive customer information during transactions.

- Compliance with Industry Standards: Adhering to the Payment Card Industry Data Security Standard (PCI DSS) is crucial for protecting your customers and maintaining your business reputation.

- Strong Passwords: Use strong, unique passwords for your WordPress login to minimize unauthorized access.

- Firewall and Security Plugins: Implement a WordPress firewall and security plugins to protect your site from potential threats.

- Familiarity with Relevant Regulations: Stay informed about GDPR, PCI DSS, and other regional data protection rules that apply to your business.

It is important to implement a comprehensive security checklist, such as the one outlined in WordPress Security Checklist for 2023, which covers a range of measures to ensure the safety and privacy.

Payment Processing Fees

Variable Fees Based on the Gateway

Different payment gateways charge varying fees for processing credit card payments. Consider these costs when choosing a gateway that aligns with your business needs and budget.

Potential for Discounts on High Volumes

Some payment gateways offer discounted processing fees for businesses with high transaction volumes, which can help lower overall costs.

Transaction Fees

Per-transaction Charges

Most payment gateways charge a fee for each transaction processed. These charges can impact your profitability, so factor them into your pricing and profit margins.

Impact on Profitability

High transaction fees can cut into your profits, so choose a payment gateway with competitive rates that won’t harm your bottom line.

International Transactions

Cross-border Fees

Some payment gateways charge additional fees for international transactions. Consider these costs when selecting a gateway, especially if your business caters to a global customer base.

Currency Conversion Rates

Be aware of currency conversion rates when accepting payments in different currencies, as fluctuations can affect your profits.

What Is a Payment Gateway and How Does It Work?

Payment gateways play an essential role in facilitating and processing credit card transactions on a WordPress website. By establishing a secure bridge between your website and credit card processing networks, payment gateways ensure the safe transmission of customer payment details.

Acting as an intermediary, a payment gateway connects your website, the customer, and the payment processor. It operates as a separate app, linking your website to its own processing servers, which allows you to accept payments like PayPal or credit card transactions without personally managing the transaction or storing sensitive credit card information on your site. For a nominal fee, the payment gateway oversees the entire process using a secure app and connection.

The payment gateway process can be summarized as follows:

- Customers choose a product or service from your online store.

- They proceed to the checkout phase and pick a payment method.

- This action triggers the payment gateway, which then appears to the customer.

- Customers input their payment information, such as credit card data or PayPal login, into the gateway app.

- The gateway securely sends the payment information to its processing servers.

- The processing server contacts the credit card servers or PayPal to obtain payment authorization.

- Once authorized, the processing server informs the gateway of the approved payment.

- The gateway subsequently notifies your eCommerce platform of the successful payment.

- Your website then releases the product or service for download or shipping and updates the customer.

- The gateway transfers the collected funds to your bank account.

- Finally, the transaction is deemed complete.

Popular WordPress Payment Gateways

Some of the most popular payment gateways for WordPress websites are:

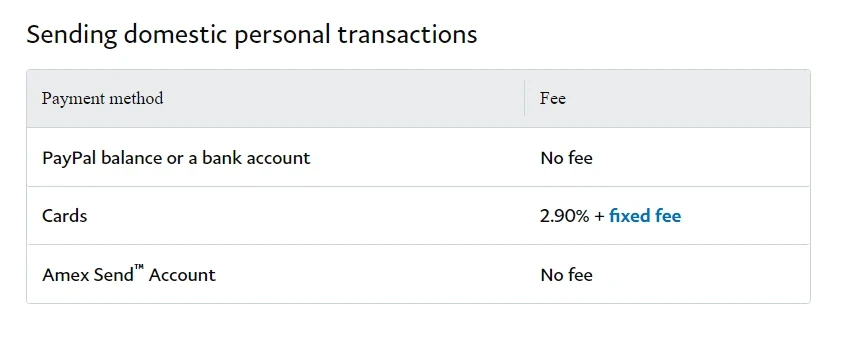

PayPal

PayPal is a widely-used payment gateway, supporting over 200 countries and multiple currencies. It offers seamless integration with WordPress and popular plugins, making it an excellent choice for many businesses.

PayPal charges a processing fee of around 2.99% + a Fixed fee (Based on currency) per transaction. However, fees may vary depending on your account and the type of transaction being processed. It also offers discounted rates for high-volume businesses and nonprofit organizations.

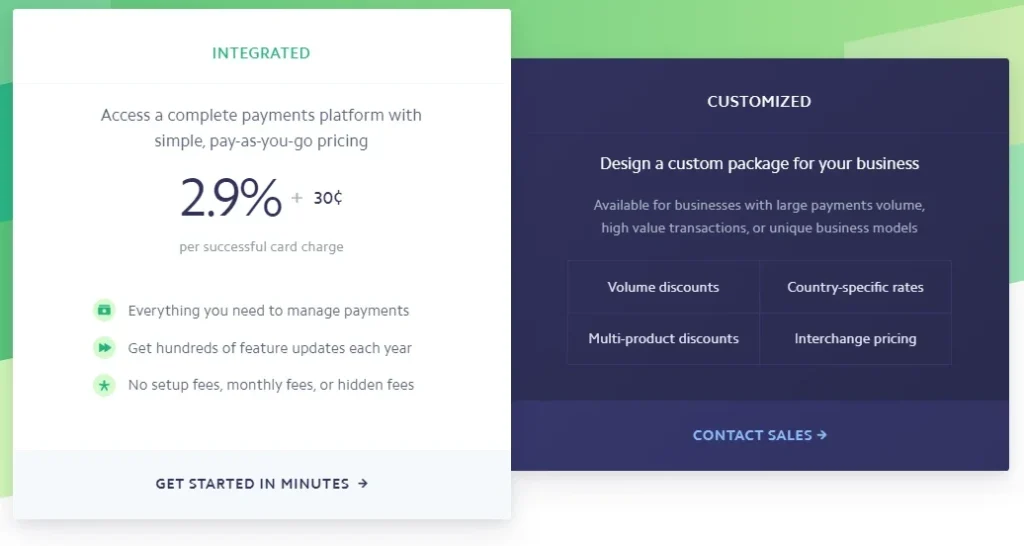

Stripe

Stripe is a popular payment gateway known for its developer-friendly features and ease of integration with WordPress. It supports over 135 currencies and provides advanced security measures, including PCI compliance assistance.

Stripe charges a processing fee of 2.9% + $0.30 per transaction. Additional fees may apply for international transactions or currency conversions. Custom pricing may be available for larger enterprises.

Also, read Stripe vs PayPal: Which One Is Better?

Amazon Pay

Amazon Pay allows customers to use their Amazon account credentials to make payments on your website. This simplifies the checkout process and can lead to increased conversions. It also offers fraud protection and supports multiple currencies.

Amazon Pay charges a processing fee of 2.9% + $0.30 per transaction on average. Additional 1% fee applies to cross-border transactions.

Google Pay

Google Pay is a mobile payment gateway that integrates with popular WordPress plugins. It supports multiple currencies and offers advanced security measures, including encryption and tokenization.

Google Pay does not charge additional fees to use Google Pay API for payments.

Authorize.Net

Authorize.Net is a well-established payment gateway that enables easy integration and secure processing of credit card transactions on WordPress websites. It accepts payments from major credit and debit cards, as well as PayPal account holders in over 136 currencies worldwide.

To use Authorize.Net, you’ll need a merchant account provider or choose to use it as an add-on through your bank or financial institution’s gateway service provider.

Authorize.net charges a monthly fee of $25 plus a $0.10 transaction fee and a $0.10 per day batch fee. If there is a payment dispute, Authorize.net will charge you $25 to handle it but will refund that if it finds in your favour.

Square

Square is a payment gateway for WooCommerce stores. It combines online payments with real-life transactions in stores, and anywhere you care to sell. It works with a WooCommerce extension that sits in WordPress and can enable fast payments for any product you sell using WooCommerce.

Square supports recurring payments and online payments, remote terminals, and a range of other technologies to widen your reach. Square charges 2.9% + $0.30 per transaction.

2Checkout

2Checkout (Now Verifone) is another very popular payment gateway that is used across the world. It accepts credit card payments and processes them on your behalf. A key strength of 2Checkout is when you’re selling digital products or subscriptions.

There are no extra fees for subscriptions, and the gateway handles everything for fully automatic recurring payments. 2Checkout charges a minimum of 3.5% plus $0.35 per successful sale.

Braintree

Braintree is owned by PayPal but operates as an independent company offering separate services. It’s a well-known payment gateway that has been around for a while and is well worth checking out.

Braintree integrates with PayPal despite being separate from it. That means customers can use their PayPal account and credit or debit cards.

For standard merchants, Braintree charges a processing fee of 2.59% + $0.49 per transaction for cards. However, fees may vary depending on the region and type of transaction being processed.

Top WordPress Credit Card Payment Plugins

Here are the top WordPress payment plugins that accept credit card payments:

WP Simple Pay

WP Simple Pay is a user-friendly plugin that allows you to accept credit card payments using Stripe. It supports one-time and recurring payments and integrates with popular WordPress page builders.

WP Simple Pay offers several add-ons for additional functionality, such as custom fields, subscription management, and coupon codes.

Easy Digital Downloads

Easy Digital Downloads is specifically designed for selling digital products and supports multiple payment gateways, including PayPal and Stripe. It includes features like discount codes, data reporting, and customizable emails.

This plugin has a range of add-ons for extending its functionality, including software licensing, recurring payments, and affiliate marketing tools.

WooCommerce

WooCommerce is a powerful eCommerce plugin for WordPress that supports various payment gateways that allow you to accept credit card payments and offers a wide range of features, such as inventory management, shipping options, and tax calculations. WooCommerce has an extensive library of extensions for adding functionality, like subscriptions, bookings, and memberships.

Gravity Forms

Gravity Forms is a versatile form builder plugin that can be used to create custom payment forms for your website. It supports several payment gateways, including PayPal, Stripe, and Authorize.Net, that accept online payments. Gravity Forms offers numerous add-ons for enhancing its functionality, such as conditional logic, file uploads, and multi-page forms.

WPForms

WPForms is a powerful form builder plugin for WordPress that makes it easy to accept credit card payments on your website. With WPForms, you can create custom payment forms that integrate with popular payment gateways like Stripe, PayPal, Square, and Authorize.Net.

What’s great about WPForms is how flexible it is. You can set up one-time or recurring payments with Stripe integration on WPForms to sell things like subscriptions or online courses.

Plus, WPForms isn’t just limited to creating payment forms – you can use it to do surveys, contact forms, and other types of customized forms on your WordPress site as well.

MemberPress

MemberPress is an all-in-one monetization and membership plugin for WordPress that can be used to create a paywall on your website. With MemberPress, you can easily accept credit card payments from subscribers while providing them with access to exclusive content or products.

The plugin allows you to connect seamlessly with WordPress using Zapier, which automates the process of sending information between the two platforms without requiring any coding knowledge.

How To Set Up A Payment Gateway On Your WordPress Site?

Setting up payment gateways to accept payments on WordPress sites require some setup in order to integrate them with your site’s shopping cart plugin or approach – as well as configuring settings that allow you to control different aspects of the payment process, such as default currencies accepted or custom checkout forms fields if needed. Following is the step-by-step guide for setting up payment options:

Creating an account with your chosen payment gateway

Sign up for an account with your preferred payment gateway by providing the required information, such as your business details and contact information.

Verification of identity and bank account

The payment gateway may require you to verify your identity and link your bank account to receive payments. Follow their guidelines to complete the verification process.

Integrating the payment method with your WordPress site

Credit card payment plugin installation and activation

Install and activate the appropriate plugin that supports your chosen payment method. Follow the plugin’s documentation for guidance on installation and activation.

API keys and credentials

Obtain the API keys and credentials from your payment gateway account, and enter them into the plugin settings on your WordPress website to establish a connection between your site and the payment gateway.

Configuring settings and options for accepting payments

Currency and location settings

Configure the currency and location settings in your payment gateway plugin to ensure accurate pricing and payment processing for your customers.

Transaction and refund settings

Set up the transaction and refund settings according to your business policies, ensuring a smooth payment process for both you and your customers.

Step-by-Step Guide To Accept Payments On WordPress

To accept credit card payments in WordPress, you can follow these simple steps:

Install WP Simple Pay

To begin accepting credit card payments on your WordPress website, you’ll need to install the WP Simple Pay plugin. This user-friendly plugin allows you to easily create custom payment forms and securely process transactions with popular payment gateways like Stripe and PayPal.

Once installed, WP Simple Pay offers flexible pricing plans that allow you to choose the best option for your business needs. From there, editing your payment button is easy, thanks to the Payment Forms section of WP Simple Pay.

Simply customize fields like pricing options, descriptions, and checkout text so customers have a seamless purchasing experience.

Connect Your Website To A Payment Processor

Connecting your WordPress website to a payment processor is essential for accepting credit card payments online. One popular option is WP Simple Pay, which allows quick and easy setup without the need for a merchant account or monthly fees.

To connect your website to a payment processor, you’ll first need to choose the right gateway that fits your business needs. Once you’ve identified the best fit, integrating it with WordPress can be done through third-party plugins available in the WordPress plugin library.

Using reliable and secure payment gateways such as WP Simple Pay and Easy Digital Downloads will help ensure smooth transactions while providing peace of mind for both you and your customers.

Add Payment Forms To Your Website

To add payment forms to your WordPress site, you can use a plugin like WP Simple Pay or integrate a payment gateway such as Stripe. With WP Simple Pay, you can easily create and customize forms that allow users to make payments directly on your website.

You can choose from various fields, such as product descriptions, quantities, and prices.

On the other hand, integrating a payment gateway like Stripe allows for more flexibility and control over the checkout process. With its powerful API, you can customize every aspect of the payment experience to match your branding and user interface.

Ultimately, adding payment forms to your WordPress site requires selecting the right tool for your needs and preferences – one that balances ease of use with functionality and security measures.

Ensuring A Secure Checkout Process For Your Customers

It’s essential to prioritize the security of your customers’ financial data during checkout by obtaining SSL certification, implementing PCI compliance, enabling two-factor authentication for added security, and utilizing fraud prevention measures.

Importance Of SSL Certification

SSL certification plays a crucial role in the process of accepting credit card payments online. It ensures that your website is secure and protects sensitive information, such as credit card details, from being intercepted by unauthorized parties.

SSL certificates help to identify website ownership and prevent attackers from creating fake sites. They also build user trust by protecting their financial data and preventing it from being stolen.

As a WordPress website owner, you can use WooCommerce Force SSL Checkout to ensure that your checkout process is secure and protected by SSL certification.

Ensuring PCI Compliance

PCI compliance is an essential component of accepting credit card payments online. This standard was created by major credit card companies to ensure that businesses that take credit card payments secure user data.

To achieve PCI compliance, you must follow strict guidelines for the processing and handling of sensitive financial data when accepting online payments. Some best practices include obtaining SSL certification, adhering to two-factor authentication for added security, implementing fraud prevention measures, and displaying security seals and icons on your website checkout pages.

Two-Factor Authentication For Added Security

To ensure a secure checkout process for your customers when accepting credit card payments online, consider implementing Two-Factor Authentication (2FA). This security method offers an added layer of protection and requires login information exclusively to personal devices and accounts.

By enabling 2FA, you can significantly reduce the risk of cyber-attacks such as data breaches, phishing scams, and identity theft. With this method in place, only authorized users can gain access to your website’s payment information.

Fraud Prevention Measures

It’s important to take steps to protect your business and customers from fraudulent transactions when accepting credit card payments online. One effective way to do this is by implementing fraud prevention measures like using payment gateway filters, using two-factor authentication for added security, and having clear refund and return policies.

For example, many payment gateways offer anti-fraud detection suites that automatically detect and block potentially fraudulent transactions before they’re processed. Another good practice is to always request encrypted data from customers during checkout to ensure their sensitive information remains safe.

Best Practices For Accepting Credit Card Payments Online

To ensure a seamless and secure checkout experience for your customers, it’s best to display security seals and icons, offer multiple payment options, simplify the checkout process, customize the checkout page, and provide clear refund and return policies.

Displaying Security Seals And Icons

Displaying security seals and icons is a critical aspect of accepting credit card payments online using WordPress. Trust seals, such as the SSL certification logo, help to establish trust and credibility with customers by verifying that their personal data will be kept private and secure during transactions.

Not only do these symbols provide peace of mind for your customers, but they can also boost conversions on your website. According to a Forbes report, 75% of customers have stated that they did not complete a purchase due to their unfamiliarity with the seal.

It’s essential to have both types of icons displayed prominently on checkout pages so that customers feel secure and confident when making a payment.

Offering Multiple Payment Options

It’s important to give your customers multiple options for payment when they’re completing purchases on your WordPress site. By offering different payment methods, you can ensure that customers don’t abandon their shopping carts due to frustration or inconvenience.

Some popular payment options besides credit cards include PayPal, Google Pay, and Amazon Pay.

In addition to reducing the likelihood of abandoned carts, offering multiple payment options can also increase customer loyalty by giving them the flexibility they need to complete transactions in their preferred way.

For example, some people may prefer paying with a digital wallet like Apple Pay, while others might prefer using their bank account for an ACH transfer.

Simplifying The Checkout Process For Customers

One of the most important aspects of accepting credit card payments online is simplifying the checkout process for your customers. Too many steps or confusing instructions can cause frustration and lead to abandoned carts.

To simplify this process, consider minimizing the number of fields on your checkout page and keeping it visually clean and organized.

Another way to simplify the process is by offering multiple payment options. This not only provides convenience for your customers but also reduces the risk of a declined transaction due to an issue with their preferred payment method.

Customizing The Checkout Page

One important step in accepting credit card payments on your WordPress website is customizing the checkout page to fit your brand and optimize the user experience. This can include adding logo and branding elements, simplifying the checkout process by eliminating unnecessary fields, and displaying clear refund and return policies.

WP Simple Pay is a popular plugin for creating custom payment forms on WordPress websites.

In addition to customization features, it is crucial to ensure that the checkout page provides a secure platform for customers to enter their sensitive information. This includes implementing SSL certification, ensuring PCI compliance, enabling two-factor authentication security measures, and using fraud prevention tools like anti-fraud detection suites offered by various payment gateways.

Providing Clear Refund And Return Policies

One vital aspect of accepting credit card payments online is having clear refund and return policies in place. It’s important to provide customers with the reassurance that they can safely purchase products or services from your website without fear of losing their money.

Your refund and return policies should be upfront, easy to understand, and easily accessible from your checkout page.

For example, consider providing clear instructions on how to initiate a refund or a return, how long it may take for the funds to be credited back to their account, and any specific conditions they need to meet for you to accept returns or refunds.

Conclusion

Accepting credit card payments on WordPress is a great way to get more customers and open up opportunities for businesses. By using various plugins and tools, users can easily integrate payment options into their websites with minimal effort required.

Not only will this allow customers to make convenient transactions, but it also helps business owners increase sales by opening up access to different payment methods that they might not have otherwise been able to offer.

For example, the WP Simple Pay plugin allows users to quickly create and edit payment forms within minutes, so there’s no need for any advanced coding knowledge.

With steadfast security protocols in place, including SSL encryption of data as well as fraud monitoring services, users can be sure their customer’s financial data is safe from malicious attacks or misuse online.

How to Easily Accept Payments on WordPress (2023)